Build A New Dimension Of Growth Into Your Real Estate Portfolios

Growth-oriented private real estate funds designed for financial advisors.

By the numbers1

$505M

Assets Under Management

29

Real Estate Funds

Powered by the Nation’s Largest Real Estate Marketplace2

CrowdStreet Advisors builds curated funds using privileged access to project flow from the CrowdStreet Marketplace.

$4.14B

Total invested through the Marketplace

766

Projects through the Marketplace

344

Nationwide sponsor network

2013

Crowdstreet Marketplace Launched

1. Information provided by CrowdStreet as of June 2023. AUM reflects Assets Under Management across funds and managed accounts. 2. Information provided by CrowdStreet as of June 2023. 3. As reported by Dr. Adam Gower in Best Real Estate Syndication Platforms | Gower Crowd - UNLEASHED, published 2022, based on dollars raised by individual investors.

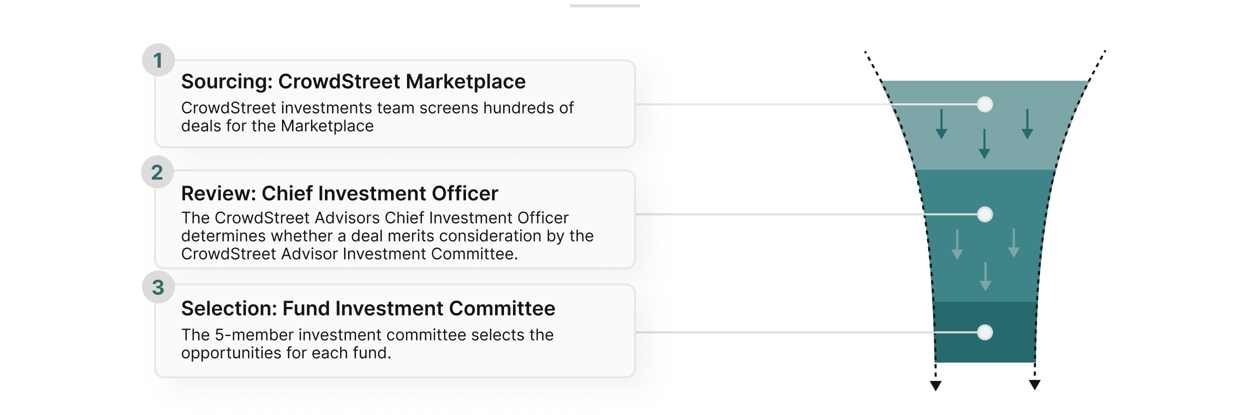

Rigorous Fund Construction Process

Navigate a Shifting Real Estate Market

Our Commercial Real Estate outlook examines major and niche asset classes, challenges in the CRE lending environment and potentially mispriced opportunities.

Contact Us

Our team is available to answer your questions.

Let's Talk

Our team is focused on helping advisors serve their clients and meet their investment objectives.

Schedule a Call